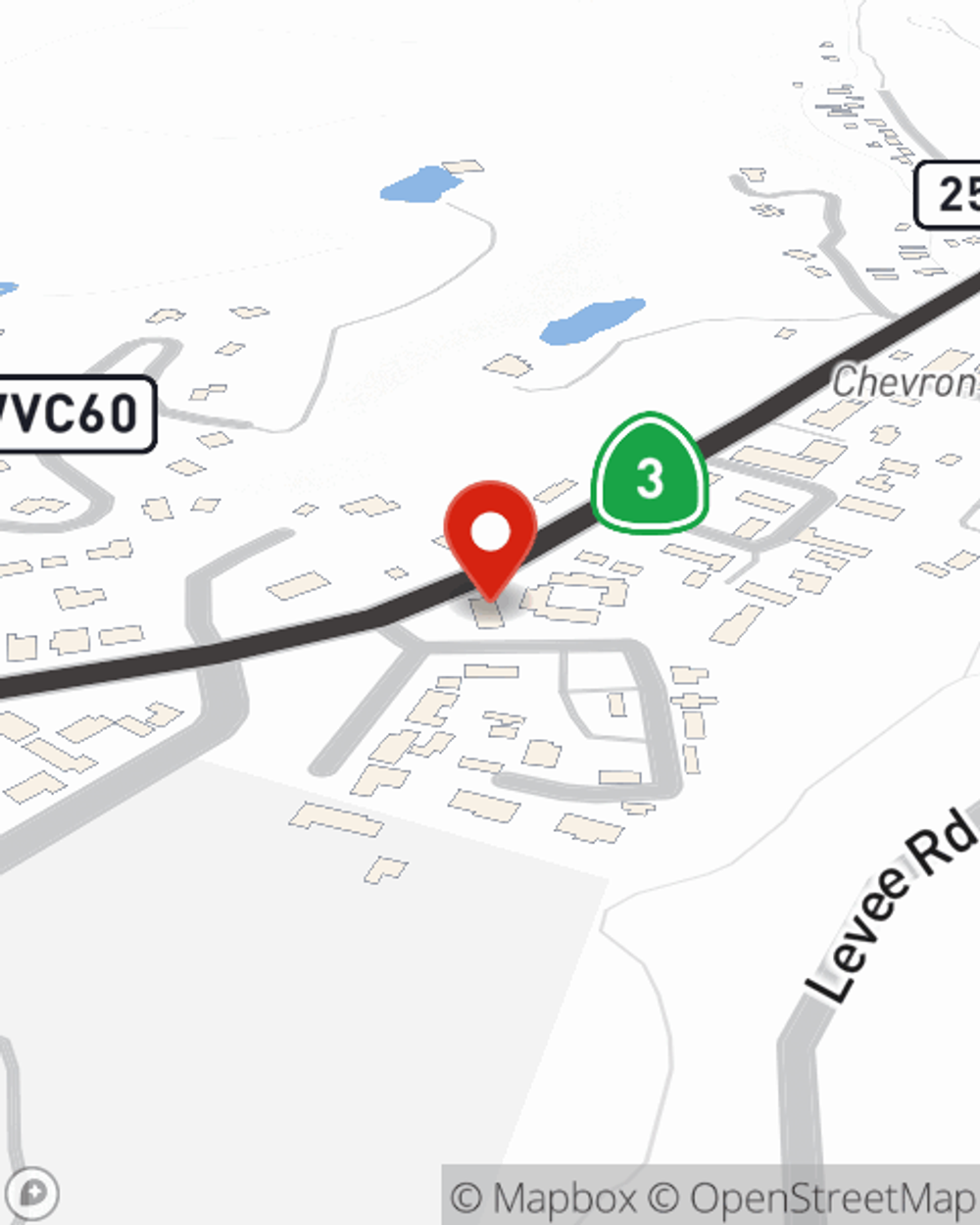

Business Insurance in and around Weaverville

Looking for small business insurance coverage?

Insure your business, intentionally

Help Prepare Your Business For The Unexpected.

As a business owner, you have to think about all areas of business, all the time. The details can be overwhelming! You can save time by working with State Farm agent Kevin Cahill. Kevin Cahill relates to where you are because all State Farm agents are business owners themselves. You'll get a business policy that covers your worries and frees you to focus on growing your business into the future.

Looking for small business insurance coverage?

Insure your business, intentionally

Surprisingly Great Insurance

Whether you are a podiatrist a plumber, or you own a bagel shop, State Farm may cover you. After all, we've been doing it for almost 100 years! State Farm agent Kevin Cahill can help you discover coverage that's right for you and your business. Your business policy can cover things such as computers and business property.

It's time to contact State Farm agent Kevin Cahill. You'll quickly observe why State Farm is one of the leaders in small business insurance.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Kevin Cahill

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.